Impact investing represents a transformative approach to capital allocation that generates measurable social and environmental benefits alongside financial returns. With the global impact investing market reaching $1.571 trillion in assets under management¹, investors are increasingly recognizing that financial success and positive planetary impact can work hand in hand. From coral reef restoration projects to sustainable agriculture initiatives, impact investments are reshaping how we address the world’s most pressing environmental challenges.

Key Takeaways

- Market Growth: The global impact investing market manages $1.571 trillion across 3,907 organizations, showing 21% compound annual growth since 20191

- Faith-Based Leadership: Faith based investors control $5 trillion in global assets, with growing alignment between values and investment strategies2

- Ocean Innovation: Companies like Coral Vita demonstrate how environmental impact alongside financial return drives meaningful ecosystem restoration

- Diverse Asset Classes: Impact investments span venture capital, private equity, affordable housing, and environmental projects across developed and emerging markets

- Measurable Outcomes: Modern impact measurement frameworks ensure accountability and transparency in achieving both financial and impact goals

Understanding Impact Investing

Impact investing fundamentally differs from traditional investment approaches by intentionally targeting investments that generate positive, measurable social or environmental impact alongside financial performance. Unlike philanthropy, which provides grants without expecting returns, impact investors actively seek profitable opportunities that address societal challenges.

The Global Impact Investing Network defines impact investments as those made with the intention to generate beneficial social and environmental impact alongside a financial return3. This dual objective attracts diverse investors, from institutional investors managing pension funds to individual asset owners seeking alignment between their values and portfolios.

The Evolution of Impact Investments

The impact investing industry has evolved significantly since its inception. Early development finance institutions pioneered this approach, but today’s market encompasses sophisticated asset allocators, venture capital funds, and private equity firms. The leading network of impact investors continues expanding globally, with representation across six continents.

Impact Investing Market Dynamics

Current market analysis reveals robust growth trajectories across multiple regions. North America dominates with 38% market share, followed by Europe’s substantial presence4. This geographic distribution reflects mature regulatory environments and established institutional support for impact-oriented strategies.

Asset Owners and Investment Strategies

Asset owners, including pension funds and insurance companies, represent significant portions of impact investing capital. Despite comprising only 14% of surveyed organizations, pension funds hold 29% of global impact assets under management5. This concentration indicates sophisticated approaches to sustainable investing among large institutional players.

Private equity and venture capital funds continue driving innovation in impact investing. These investment vehicles excel at identifying high-growth opportunities that address environmental challenges while delivering competitive returns to investors.

Environmental Impact Alongside Financial Performance

Environmental initiatives represent core focus areas within impact investing portfolios. Climate change mitigation, ocean conservation, and sustainable agriculture projects attract substantial capital flows from mission-driven investors.

Coral Reef Restoration as Impact Investment

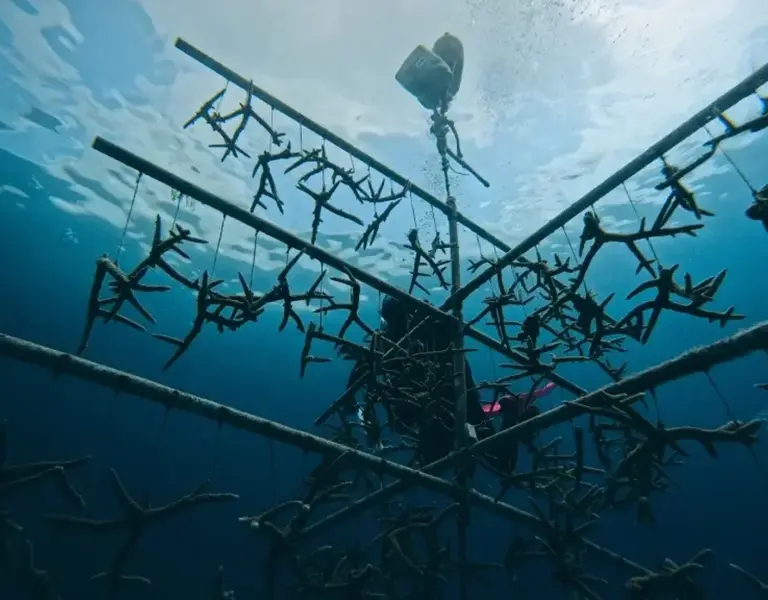

Coral Vita exemplifies successful environmental impact investing. The company recently raised over $8 million in Series A funding led by Builders Vision, demonstrating investor confidence in scalable ocean restoration solutions6. Their innovative land-based coral farming technology grows resilient corals 50 times faster than natural processes, transforming decades-long restoration timelines into months.

This breakthrough represents more than scientific advancement—it validates the blue economy as an investable sector. Coral reefs generate $2.7 trillion annually in economic value while supporting one billion people globally7. By addressing the crisis threatening 90% of coral reefs by 2050, Coral Vita proves that environmental impact and business viability can align perfectly.

Measuring Environmental Benefits

Sophisticated impact measurement frameworks ensure accountability in environmental investing. Organizations utilize standardized metrics to track outcomes like carbon reduction, biodiversity preservation, and ecosystem restoration. These measurement approaches enable investors to compare performance across different environmental projects and geographies.

Faith Based Investors and Values Alignment

Faith based investors represent a powerful force in impact investing, collectively stewarding trillions in global assets. These investors increasingly move beyond simple screening approaches toward proactive impact strategies that reflect their core values and beliefs.

The Global Impact Investing Network’s Faith-Based Investors Hub facilitates collaboration among Christian, Jewish, and Islamic investment traditions8. This platform enables values-driven capital allocation toward United Nations Sustainable Development Goals and climate objectives.

Growing Faith-Based Market Participation

Recent research indicates that faith-based investing assets exceed $2 billion in exchange traded funds alone9. Organizations like GuideStone Funds and Inspire Investing demonstrate how faith-based investors can achieve competitive financial performance while maintaining strict values alignment.

These investors prioritize investments in affordable housing, healthcare access, education initiatives, and environmental stewardship. Their long-term investment horizons particularly suit impact strategies requiring patient capital for maximum effectiveness.

Asset Classes and Investment Vehicles

Impact investing spans diverse asset classes, enabling investors to construct portfolios matching their risk-return preferences and impact objectives. Public equity investments offer liquidity and transparency, while private funds provide access to earlier-stage innovation and direct community impact.

Public Markets and Equity Investments

Public equity represents the largest segment of impact investing assets, providing accessibility for retail and institutional investors alike. Sustainable equity strategies screen for companies demonstrating positive environmental and social practices while avoiding harmful industries.

Exchange traded funds specifically designed for impact investing offer diversified exposure to impact-oriented companies. These vehicles enable broader market participation while maintaining focus on measurable impact outcomes.

Private Equity and Venture Capital

Private markets excel at funding innovative solutions requiring development capital and operational support. Venture capital funds targeting environmental technologies, healthcare innovations, and financial inclusion drive breakthrough solutions to complex global challenges.

Private equity investors often engage actively with portfolio companies to enhance both financial performance and impact outcomes. This hands-on approach proves particularly effective for scaling proven impact models across new markets and geographies.

Emerging Markets and Development Finance

Emerging markets present significant opportunities for impact investors seeking to address poverty, infrastructure gaps, and environmental degradation. Development finance institutions have pioneered many impact investing approaches now adopted by commercial investors.

Small Business and Job Creation

Small business financing represents a critical focus area within emerging market impact investing. These investments directly support job creation, economic development, and community resilience in underserved regions.

Microfinance and small business lending platforms leverage technology to expand access to capital for entrepreneurs traditionally excluded from formal financial systems. These initiatives demonstrate measurable social impact through employment generation and poverty reduction.

Infrastructure and Sustainable Agriculture

Infrastructure investments in emerging markets address fundamental development needs while generating stable returns for investors. Projects spanning clean energy access, water systems, and transportation networks create lasting social and environmental benefits.

Sustainable agriculture initiatives support food security, rural development, and climate resilience. These investments often combine innovative farming techniques with fair trade practices, creating value for farmers while meeting growing global food demand sustainably.

Environmental Challenges and Climate Solutions

Climate change represents the defining environmental challenge of our time, requiring unprecedented capital mobilization toward mitigation and adaptation solutions. Impact investors increasingly prioritize climate-focused strategies addressing renewable energy, energy efficiency, and natural climate solutions.

Ocean Conservation and Blue Economy

Ocean health initiatives like coral reef restoration demonstrate the blue economy’s investment potential. Marine ecosystems provide critical services including coastal protection, fisheries, and carbon sequestration, creating economic value worth trillions globally.

Companies working on ocean conservation, sustainable fisheries, and marine renewable energy attract growing investor interest. These opportunities address urgent environmental needs while accessing large, underserved markets.

Renewable Energy and Clean Technology

Renewable energy represents the most mature segment of climate impact investing. Solar, wind, and energy storage technologies achieve increasingly competitive returns while delivering substantial emissions reductions.

Clean technology investments span transportation electrification, industrial decarbonization, and sustainable materials development. These sectors offer significant growth potential as global economies transition toward net-zero emissions.

Institutional Investors and Market Growth

Institutional investors increasingly integrate impact considerations into their investment processes. Pension funds, insurance companies, and endowments recognize that environmental and social risks materially affect long-term portfolio performance.

Asset Allocators and Portfolio Integration

Sophisticated asset allocators develop dedicated impact allocation targets while integrating impact considerations across traditional asset classes. This approach maximizes impact potential while maintaining portfolio diversification and risk management.

Many institutions commit specific percentages of assets under management to impact strategies, creating predictable capital flows for impact investment managers. These commitments signal long-term market growth potential and encourage manager innovation.

Performance and Risk Management

Research consistently demonstrates that well-managed impact investments achieve competitive financial returns while delivering measurable impact outcomes. This performance record attracts additional institutional capital and validates impact investing as a legitimate investment strategy.

Risk management in impact investing requires careful attention to both financial and impact metrics. Successful investors develop frameworks balancing return expectations with impact objectives, ensuring neither goal compromises the other.

The Role of Technology and Innovation

Technology increasingly enables impact measurement, portfolio management, and impact delivery across investment strategies. Digital platforms facilitate transparency, reduce transaction costs, and expand access to impact opportunities.

Impact Measurement and Data Analytics

Advanced analytics enable real-time impact monitoring and performance optimization. These tools help investors understand which interventions produce the greatest social and environmental benefits relative to capital invested.

Standardized impact metrics facilitate comparison across investments and asset classes. This comparability supports better capital allocation decisions and encourages continuous improvement in impact delivery.

Fintech and Financial Inclusion

Financial technology innovations expand access to banking, credit, and investment services for underserved populations globally. These platforms demonstrate how technology can address social challenges while building sustainable business models.

Mobile payments, digital lending, and robo-advisory services reach previously excluded communities, creating economic opportunities and building financial resilience. These innovations represent significant market opportunities for impact investors.

Market Rate Returns and Financial Performance

Modern impact investing deliberately targets market rate returns, distinguishing it from concessionary capital approaches. This focus on competitive financial performance attracts broader investor participation and scales capital availability for impact solutions.

Performance Measurement and Benchmarking

Rigorous performance measurement ensures impact investments meet both financial and impact objectives. Benchmark development enables comparison with traditional investments and identification of best practices across the impact investing industry.

Long-term performance data increasingly supports the investment case for impact strategies. Organizations tracking performance over multiple market cycles demonstrate that impact considerations enhance rather than detract from financial returns.

Risk-Adjusted Returns and Portfolio Construction

Sophisticated impact investors construct portfolios balancing risk, return, and impact across multiple asset classes and geographies. This diversification approach manages downside risk while maximizing positive impact delivery.

Modern portfolio theory principles apply equally to impact investing, with additional consideration for impact correlation and social/environmental risk factors. These frameworks support institutional adoption of impact strategies.

Future Outlook and Market Expansion

The impact investing market continues expanding rapidly, driven by growing awareness of environmental and social challenges alongside evolving investor preferences. Regulatory support and institutional commitment provide additional momentum for market growth.

Regulatory Environment and Policy Support

Government policies increasingly support impact investing through tax incentives, regulatory frameworks, and direct co-investment. These initiatives reduce barriers to impact investment and encourage private sector participation in addressing public challenges.

International frameworks like the UN Sustainable Development Goals provide common reference points for impact measurement and coordination. This alignment facilitates cross-border investment and knowledge sharing among impact investors globally.

Next Generation Investors and Values Alignment

Millennial and Generation Z investors prioritize values alignment in their investment decisions, driving demand for impact investing products and services. This demographic shift ensures continued market growth as wealth transfers accelerate.

Younger investors demonstrate willingness to accept modestly lower returns for significant social and environmental impact. This preference supports continued innovation in impact investing products and strategies.

Conclusion

Impact investing has evolved from a niche strategy to a mainstream investment approach managing over $1.571 trillion globally. This growth reflects increasing recognition that financial success and positive impact can align perfectly when investments are structured thoughtfully and managed professionally.

Companies like Coral Vita demonstrate how environmental challenges create investment opportunities for those willing to innovate. Their successful Series A funding round proves that ocean conservation and coral restoration can attract significant capital while delivering both environmental benefits and financial returns. As the blue economy continues developing, such examples will likely multiply, creating additional opportunities for impact investors.

The path forward requires continued collaboration among investors, entrepreneurs, and policymakers to address regulatory barriers, standardize impact measurement, and scale proven solutions. With trillions more dollars needed to achieve global sustainability goals, impact investing represents humanity’s best hope for mobilizing sufficient capital toward our most pressing challenges.

As more investors recognize that their capital can drive positive change while achieving competitive returns, impact investing will continue its transformation from alternative strategy to investment mainstream. This evolution offers hope that financial markets can become powerful forces for environmental restoration, social justice, and sustainable development worldwide.

About Coral Vita

Coral Vita is a mission-driven company dedicated to restoring our world’s dying and damaged reefs. Using innovative land-based farming techniques, Coral Vita grows diverse and resilient corals in months instead of the decades they take in nature. These corals are then transplanted into threatened reefs, helping to preserve ocean biodiversity while protecting coastal communities that depend on healthy reefs for protection, food, and income.

Founded by environmental entrepreneurs Sam Teicher and Gator Halpern, Coral Vita’s high-tech coral farms incorporate breakthrough methods to restore reefs in the most effective way possible. In 2021, the company was recognized as the inaugural winner of Prince’s William’s Revive Our Oceans Earthshot Prize Winner for their pioneering work in coral restoration.

To learn more about Coral Vita’s work or to get involved in coral reef conservation efforts, visit their website at www.coralvita.co or contact them directly through their Contact Us page.

FAQ

What is impact investing and how does it work?

Impact investing involves making investments with the intention to generate positive, measurable social and environmental impact alongside financial returns. Investors target companies and projects addressing challenges like climate change, poverty, and environmental degradation while seeking competitive profits.

How large is the current impact investing market?

The Global Impact Investing Network estimates the current market size at $1.571 trillion in assets under management across 3,907 organizations worldwide, representing significant growth from previous years and demonstrating mainstream adoption of impact strategies.

What types of investments qualify as impact investments?

Impact investments span multiple asset classes including public equity, private equity, venture capital, fixed income, and real assets. Examples include renewable energy projects, affordable housing, sustainable agriculture, healthcare access, and environmental restoration like coral reef farming.

Can impact investments achieve competitive financial returns?

Research consistently shows that well-managed impact investments can achieve market rate returns while delivering measurable social and environmental benefits. Many institutional investors report satisfaction with both financial performance and impact outcomes from their impact investment portfolios.

References

- https://thegiin.org/publication/research/sizing-the-impact-investing-market-2024/ ↩︎

- https://www.faithinvest.org/ ↩︎

- https://thegiin.org/ ↩︎

- https://www.grandviewresearch.com/industry-analysis/impact-investing-market-report ↩︎

- https://impact-investor.com/giin-survey-global-impact-market-reaches-1-57trn-aum/ ↩︎

- https://www.buildersvision.com/partner-spotlights-and-case-studies/how-builders-vision-unlocked-8-million-for-coral-vita-to-scale-coral-reef-restoration ↩︎

- https://coralvita.co/in-the-press/coral-vita-raises-8m-series-a-led-by-builders-vision-impactalpha/ ↩︎

- https://thegiin.org/faith-based-investors-hub/ ↩︎

- https://www.inspireetf.com/ ↩︎